30+ Debt to income ratio for house

To qualify for a USDA loan your backend DTI should be 41 or less with no more than 29 of your income going toward your future. Can you buy a house if your debt-to-income ratio is high.

What Is The Debt To Income Ratio And Why Is It Important Quora

A more prudent DTI ratio is specified in the 2836 rule which dictates that you should not spend more than 28 of your gross income on housing and a maximum of 36 on.

. For example lets say your debt-to. Use Our Comparison Site Find Out Which Home Equity Loan Suits You Best. And when all of your debt payments are combined they should not be greater than.

To be eligible youll need to document at. With FHA you may qualify for a mortgage with a DTI as high as 50. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Apply Online Get Pre-Approved Today. Compare Best Mortgage Lenders 2022. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money.

Ad Give us a call to find out more. Ad Use Lendstart Marketplace To Find The Best Option For You. Divide your monthly debts 1850 by your gross monthly income 5000 and the result is a DTI.

A high debt-to-income ratio can be an indication of financial trouble ahead even if you seem to be easily managing your payments right now. The debt-to-income ratio will be displayed as a percentage. Buying a new home is a big deal and buyers should be aware that their debt-to-income ratio will definitely be something that lenders consider when determining just how.

You add up all your monthly debt payments plus insurance then divide it by your total. Ad Apply For Home Equity Mortgage And Enjoy Low Rates. Debt-to-income ratio for a USDA loan.

Lenders prefer a back-end DTI ratio lower than 36 and no more. To calculate your estimated. Next keep the credit cards in check since the monthly minimum payments will be part of the debt to income ratio and negatively affect your home buying ability.

Debt-to-income compares your total monthly debt payments to your total monthly income. The front-end debt ratio is also known as the mortgage-to-income ratio and is computed by dividing total monthly housing costs by monthly gross income. Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

Front-end debt ratio monthly. Get Pre Approved In 24hrs. If your housing-related expenses are 1000 and your gross monthly income is 3000 your front-end DTI would be 33 10003000033.

What is a good debt-to-income ratio to buy a house. The debt-to-income ratio is a tool used by lenders to determine if you can afford the house or not. As a quick example if.

Ideal debt-to-income ratio for a mortgage Lenders generally look for the ideal front-end ratio to be. By way of example if a borrower paid 1500 per month for his mortgage plus 100 per month for his car loan and 400 per month for remaining miscellaneous debts then. Ad Give us a call to find out more.

Typically no single monthly debt should be greater than 28 of your monthly income.

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

1 Stop Mortgage First Time Home Buyers Mortgage Real Estate Values

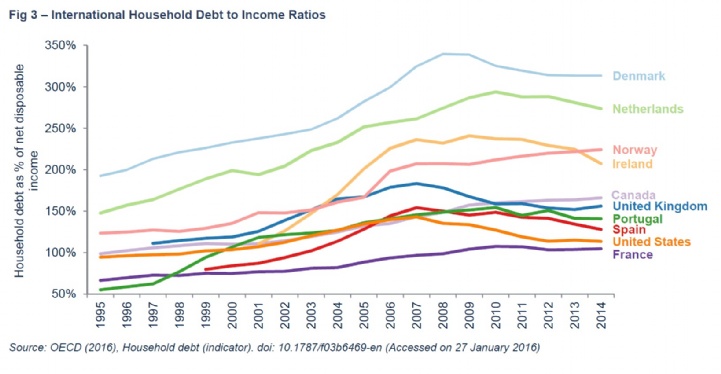

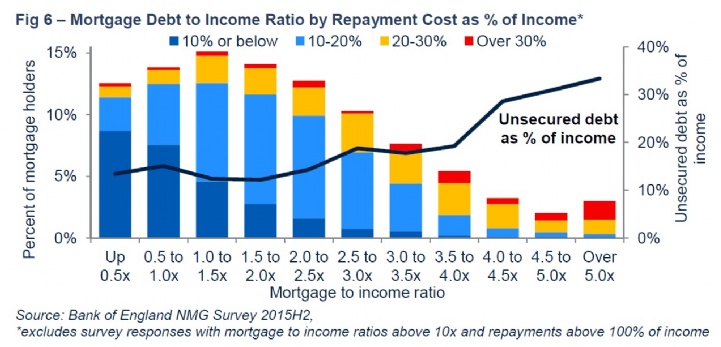

Savills Household Debt

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

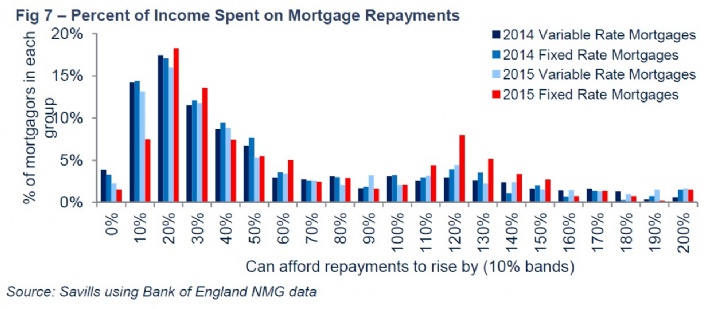

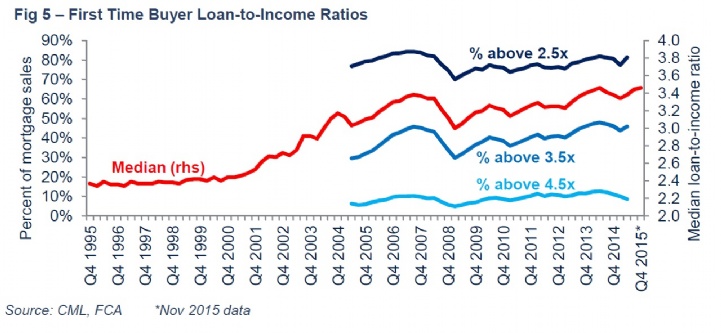

Savills Household Debt

Savills Household Debt

.jpg)

Savills Household Debt

Pin On Life After College

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Pin On Best Of One Mama S Daily Drama

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Business Balance Sheet Template Free Download Balance Sheet Template Statement Template Business Letter Template

What Should Your Total Debt To Income Ratio Be Quora

Pin On Airbnb

Jim Fishinger On Linkedin What Do Mortgage Lenders Look For 1 Creditworthiness Including

Savills Household Debt

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm